Home loan calculators and tools

Table of Content

Loans for an investment purpose include – but aren’t limited to – loans where the predominant part of the loan is used to invest in shares, land, construction or an established dwelling . Effective 16 December,Westpac Life and Westpac’s Spend&Save will increase its saving rates. We don’t charge fees for card purchases or transactions made or processed outside Australia but others, such as the banks of international merchants, might. Once you’ve submitted your application, one of our friendly banking specialists will review it and get in touch to answer any questions and guide you through the next steps. The value of your property is assumed to be the same as the amount you'd like to borrow plus deposit. Your LVR is calculated by dividing the amount you'd like to borrow by the value of the property as a percentage.

1 Comparison rates are based on a secured loan of $150,000 over a term of 25 years. If you apply for a new or increased loan with us, we will separately value your property, and our valuation may be different. For NAB products, the rate that will initially apply to a loan will be the prevailing rate for the product at the drawdown of the loan . To save you time with filling out our online forms, we may pass through some of the information you entered into the calculators.

You may be eligible for additional concessions

Effective 13 December, ING will increase its home loan variable rates by 0.25% p.a. Effective 10 December, ME Bank will increase its home loan variable rates by 0.25% p.a. Effective 20 December, BankSA will increase home loan variable rates by 0.25% p.a. Effective 20 December, Westpac will increase its home loan variable rates by 0.25% p.a.

Discounts are offered to new home loan applications only. The discount cannot be used with any other rate promotion. Existing applications, internal refinances, top ups, additional advances or variations of existing home loans are not eligible.

More calculators

Amortisation calculator See what percentage of your bond repayment goes towards capital and what percentage goes towards interest. In the U.S., most of the consumer loans are set to be repaid monthly. Home loan cashback promotion is available to Australian residents aged 18+ who refinance a property with a new Bankwest home loan. Make sure you’re covered withhome insurance optionsfor home owners, landlords and renters. It will also increase its Boost Saver account by 0.45% p.a. To help you keep track of significant changes from popular lenders, this page will be regularly updated with the size of the increase and when it will come into effect.

The calculations only include government registration costs and stamp duty on the transfer of land for the purchase price you enter and on one real property mortgage. You should also estimate an amount for lenders mortgage insurance and add this to your budget if you believe it will apply to you. If knowing exactly what your loan repayments will be is important to you, Bankwest’s Fixed Rate Loan is definitely something to consider.

Email my calculations

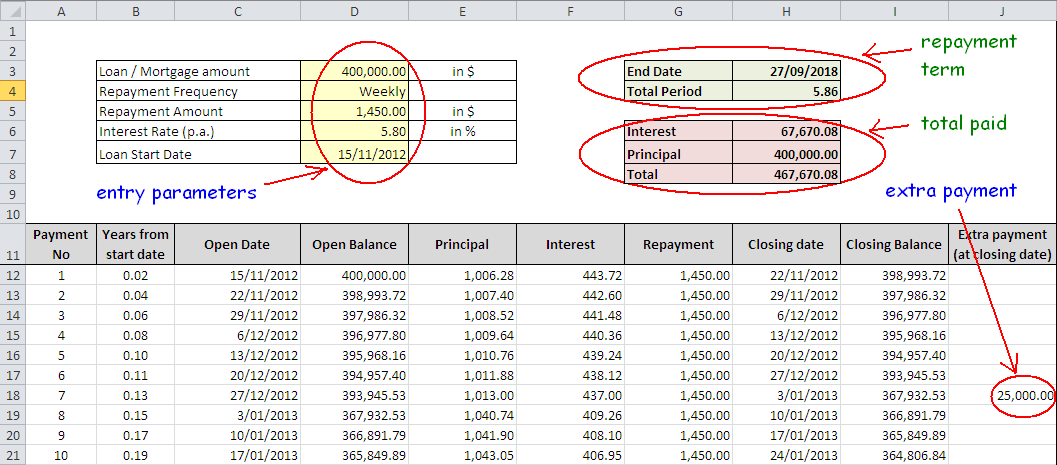

Calculate your mortgage repayments and discover how much you could save if you make extra repayments. We don't consider your personal objectives, financial situation or needs and we aren't recommending any specific product to you. You should make your own decision after reading the PDS or offer documentation, or seeking independent advice. Effective 8 December, Athena will increase its home loan variable rates by 0.25% p.a. Effective 19 December, MyState Bank will increase its home loan variable rates by 0.25% p.a.

We may change or withdraw any discount or margin at any time. Find out your estimated home loan repayments as well as ways to pay off your home loan faster. This is sometimes called the amortisation schedule of your loan. This calculator can also be used to generate a Key Facts Sheet for a NAB product with a principal and interest period. Like mortgage loans, auto loans need to be repaid monthly, usually at fixed interest rates. Borrowers can also choose to pay more than the required repayment amount.

Effective 16 December, NAB will increase variable rates for home loans by 0.25% p.a. Effective 16 December, CBA will increase its home loan variable rates by 0.25% p.a. Effective 16 December, ANZ will increase is home loan variable rates by 0.25% p.a.

Learn more about agent fees at theWhich Real Estate Agent website. A Principal and Interest loan with the rate and remaining term you have input. If you have dependents and/or the total gross income of all applicants is less than $160,000, check with your state revenue office, opens in a new window to see if you're eligible for additional concessions. We have also made a number of assumptions when calculating your borrowing power. Those assumptions affect how reliable the borrowing power amount is. Six months' of your recent home loan statements from your other financial institution (if you’re refinancing).

In only two minutes you could have an obligation-free indication of your borrowing power. SMSFSMSF Cash High variable interest rate on the cash component of your Self Managed Superannuation Fund. All credit cards Clear and simple, with easy-to-use features so you can stay on top of your finances. Orange Everyday bank account Because when it comes to your money, every little bit counts.

Assistance options are available to support customers financially impacted by COVID-19. We’re proud to be a provider of the First Home Guarantee, where eligible first home buyers can have as little as a 5% deposit towards their home. Our handy calculators make light work of the number game. Based on your loan options, here's what you're up for.

Eligible customers will receive $2,000 cashback transferred electronically into their new home loan account. Maria Gil writes across all of our personal finance areas here at Mozo. Her goal is to help you think smarter about money and have more in your pocket. Maria earned a journalism degree in Florida in the United States, where she has contributed to major news outlets such as The Miami Herald. She also completed a masters of digital communications at the University of Sydney.

After the interest only period, your principal and interest repayments will be higher than these repayments. Additional payment calculator Enter the additional amount you could pay into your bond to see how much you can save in time and money on your home loan. If there is no prepayment penalty involved, any extra money going towards a loan will be used to lower the principal amount due.

Comments

Post a Comment